Materiality

The Process for Identifying Materiality Issues

Once material issues are identified, those issues are prioritized through ;

- Workshop with management and working team by analyzing the financial impacts, risks, reputation, and the Company’s target.

- Consulted with and listened to the stakeholders’ perceptions to understand their significant impacts.

AWC believes sustainable development is a continuous process that thrives through regular monitoring sustainability performance and assessment of material topics at least annually, and keeping up with stakeholders' concerns and expectations, which may change over time. As such, AWC has implemented a review and evaluation process to gain insights into opportunities for improvement and future sustainability directions. The identified material issues were prioritize based on both impacts and importances on AWC and its stakeholders through workshop with management and working team and stakeholders’ perceptions consultation according to double materiality principal. Materiality assessment results are approved at the board level by the Corporate Governance and Sustainability Committee. The identified materiality issues are subsequently integrated in Enterprise Risk Management process to ensure development and implementation of corporate strategy to address stakeholder expectations and concerns. AWC welcomes stakeholders to voice their opinions to foster a sustainable society and realize AWC’s vision of “Building a Better Future”.

Identification

Process

Materiality matrix

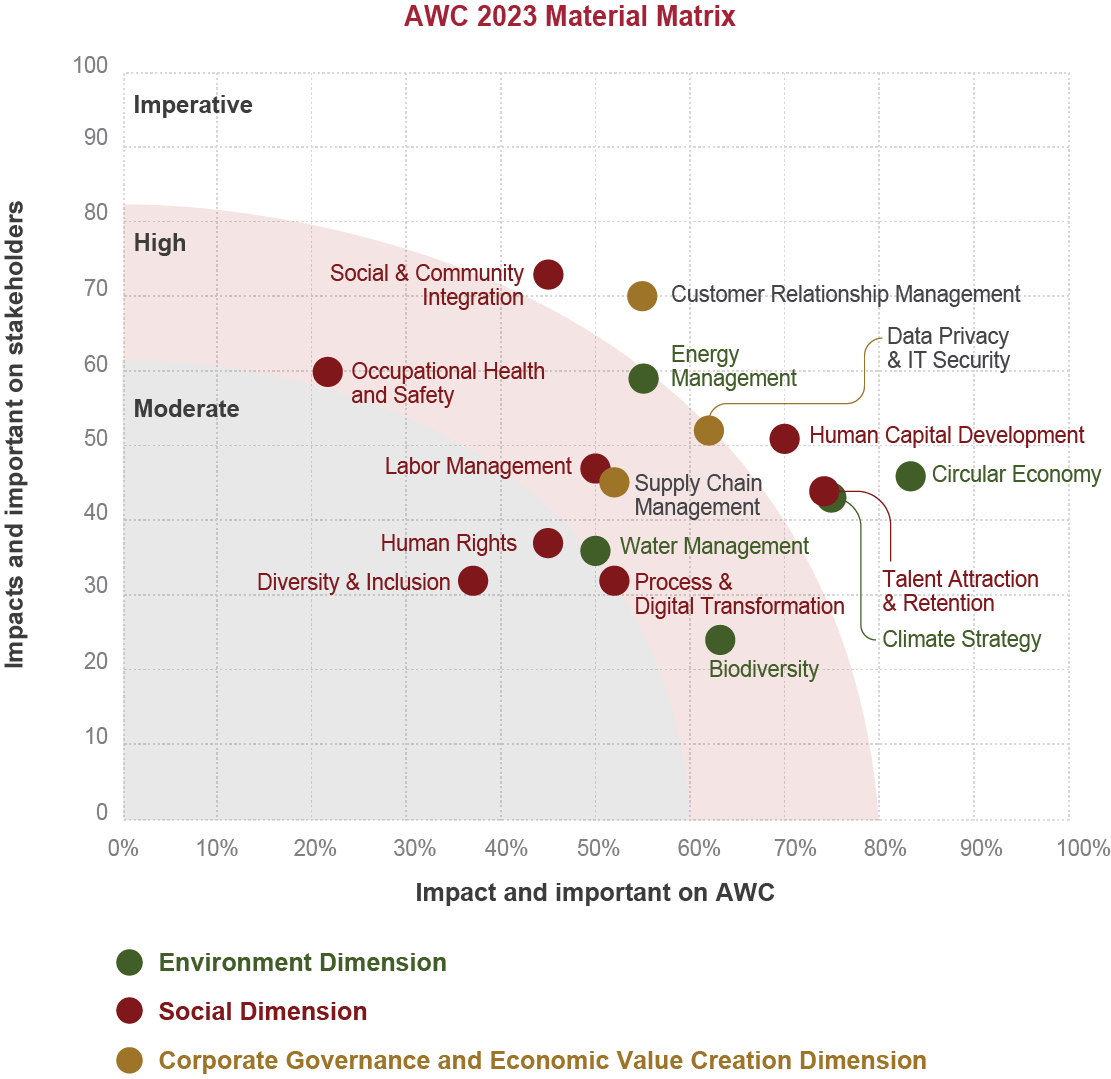

The materiality assessment clarified in the previous section resulted in the Materiality Matrix, which displays AWC material issues importance based on what’s critical to stakeholders and essential to AWC, simultaneously revealing material issue’s significance.

In pursuing corporate sustainability agenda, AWC has positioned corporate governance and code of conduct as a foundation to operate, climate change as the essence of long-term sustainability, and risk management to safeguard AWC’s resilience. The other issues are captured to strengthen AWC’s abilities and deliver value creation to stakeholders in its entire value chain.

AWC Materiality Issue and KPI

| Materiality Topic | Target by 2030 | Progress | UNSDGs |

|---|---|---|---|

| BETTER PLANET | |||

| Climate Change | Become a carbon-neutral organization (Scope 1 and 2) | Reduced GHG emission (Scope 1 & 2) per unit area 5.5% compared to 2019 baseline |

|

| Water Stewardship | Reduce 20% water consumption per revenue | Reduced water usage per revenue 80.5% compared 2019 baseline |

|

| Circular Economy | Manage waste from operating assets to achieve zero waste to landfill | Diverted 25% of landfill waste from our operations |

|

| Biodiversity | 100% of projects have a net positive impact on biodiversity | Conducted biodiversity impact assessment using the WWF Biodiversity Risk Filter framework 100% of all projects |

|

| BETTER PEOPLE | |||

| Human Capital Development | 100% of key positions have ready-now successors | 73% of key positions have ready-now successors |

|

| Occupational Health and Safety | Zero accident rate from operations resulting in a fatality or permanent disability | 0 fatalities |

|

| Community and Social Integration | Build strong relationships with 240 new communities in every project area and all business units, promoting the quality of life for people and society through the creation of all significant projects in 2030 with a social return on investment (SROI)≥1.5 | In process of community survey and setting up SROI baseline |

|

| BETTER PROSPERITY | |||

| Corporate Governance | Receive 5 Golden Arrow recognitions from ACGS (ASEAN Corporate Governance Scorecard) | Submitted the ACGS Checklist 2024 to the Thai Institute of Directors (Thai IOD) for the ASEAN CG Scorecard assessment. |

|

| Economic Value Creation | Increased household income per capita of AWC’s employee | In process of targeting, and setting up quantitative measurement and baseline |

|

Material Issues and Impacts for External Stakeholders

| Material Issues | Output Metrics | Coverage of Business Activity | Impact Valuation | Impact Values (Million THB) | References | Impact Types | Significance for External Stakeholders |

|---|---|---|---|---|---|---|---|

| Circular Economy | |||||||

| 6,639.64 ton of waste diverted | 100% of Operating Assets and Developing Assets (only assets in construction stage) | Social Cost of Carbon avoided from waste diverted = Total Waste diverted × Avg landfill EF (0.7933 tCO2e/t) × Social Cost of Carbon (SCC) 208 USD/tCO2e (2% discount rate) | 37.41 | TGO Emission Factor (landfill), US EPA (2023), SCC 208 USD/tCO2e (2%) | Positive | Diverting waste from landfill reduces methane and CO2 emissions, directly benefiting the environment and society. This metric highlights AWC’s positive contribution to climate action. | |

| 8567.21 ton of landfilled waste | 48.27 | TGO Emission Factor (landfill), US EPA (2023), SCC 208 USD/tCO2e (2%) | Negative | Landfilling waste generates GHG emissions that negatively impact the environment and society. Quantifying this makes the external cost visible to stakeholders. | |||

| Data Privacy & IT Security | |||||||

| 9 cases of protected phishing | 38% of business activities related to customer and internal data management systems (Head Office + 12 of 33 Operating Assets) | Valuation proxy = Monetary fine × number of breaches avoided | 45.00 | Personal Data Protection Act B.E. 2562 (2019): Criminal Liability Section 79 Any Data Controller who violates the provisions under Section 27 paragraph one or paragraph two, or fails to comply with Section 28, which relates to the Personal Data under Section 26 in a manner that is likely to cause other person to suffer any damage, impair his or her reputation, or expose such other person to be scorned, hated, orhumiliated, shall be punished with imprisonment for a term not exceeding six months, or a fine not exceeding five hundred thousand Baht, or both. | Positive | Cyberattacks pose risks to customers, employees, and partners globally. Protecting data avoids financial loss, reputational damage, and systemic risk, reinforcing stakeholder trust. |